Getting Started

Going through a separation or divorce can be a challenging and overwhelming endeavour for so many reasons unique to your situation. It can also be a daunting undertaking during one of the most trying times of your life. For those reasons, it is important to consult a lawyer with expertise in family law. We are here to guide you through this process in a timely, empathetic, and cost effective manner that will assist you in creating the most fitting resolution for your family.

Keep Reading

WK Family Lawyers LLP is a top rated Calgary Family Law firm. We specialize exclusively in family law and provide exceptional legal counsel and support to our clients during a difficult transition period. With over 100 years experience in the field, we can help resolve issues you will undoubtedly encounter during divorce or separation.

Learn more about getting started with your divorce or separation in Alberta in the guide below including:

- Options for how you can divorce or separate in Alberta

- Preparing financial disclosure

- Issues that may arise during your divorce or separation

- Tips to help you make smart decisions for you and your family

- Alternative Dispute Resolution Options

You may also want to familiarize yourself with divorce and separation terminology that might help as you begin this process.

Child Custody & Parenting Arrangements

Making decisions about parenting after a separation is typically one of our clients’ paramount concerns. There are many decisions to be made, but most importantly parents need to consider how they will make decisions affecting their children, and how the division of parenting time will be between parents and children. If parents are able to agree on a parenting plan that is in the best interests of the children, the courts will generally not interfere.

Keep Reading

It is important, however, to ensure that a parenting plan is carefully considered and comprehensive. Plans that are not well designed may lead to unanticipated conflict and instability in the future which may negatively affect children.

When separating parents cannot agree to a parenting plan, they can use mediation, arbitration, parenting coordination and/or the courts to assist.

According to the Divorce Act and the Family Law Act, decisions around parenting are based on “the best interests of the child.” This means that all circumstances and factors affecting the child need to be considered. A parenting plan will address these questions:

- Who will make significant decisions for the children? When married parents are going through divorce or separation, Joint Custody means that both parents make these decisions, whereas Sole Custody means that one parent will make these decisions. These terms are not used under the Family Law Act for unmarried or common law parents but rather the terminology is “who will have decision making abilities for the children.”

- How will time be scheduled/shared with the children and the parents? Primary or residential care means that one parent has the majority of the time with the children (60% or more). Shared Custody/Shared Parenting means that the parents equally share time with the children (between 40% to 60%).

- How will holidays and the summer be shared?

- How will the parents choose and schedule extracurricular activities, school events and medical/dental appointments?

- How will consent/notice of travel with the children be decided?

- How will medical emergencies be handled?

- What will occur when one parent needs care of the children during their parenting time?

In Alberta, the Parenting After Separation course is available and recommended before a divorce will be granted. It is a free seminar that can be taken online. This course offers information to parents about the separation and divorce process, the effects of separation and divorce on children, techniques for communication, and legal information that affects parents and children.

The course teaches parents the importance of working together to meet children’s health, social, educational, and emotional needs. The program encourages parents to attend mediation and to consider other dispute resolution options.

There is also a High Conflict Parenting After Separation Course sometimes recommended.

Child Support

Child Support is a monthly payment from one parent to the other to assist in the financial obligations of raising a child. It will be paid by the child’s biological parents, or in some circumstances, by a step-parent.

Depending on whether the parents are married or unmarried, the child support payable may be determined under either federal legislation (for married couples) or provincial legislation (for unmarried couples). With some exceptions, the legislative principles are the same. The amounts payable for child support are governed by the Child Support Guidelines.

Keep Reading

There are essentially two components to child support. First, there is a “base” support payment made by one parent to the other. This payment is determined with reference to legislated tables (the “Guidelines”), also known as Section 3, depending on the payor’s province of residence, the number of children for whom support is to be paid, and the payor’s income.

Support is generally paid by the non-custodial parent to the custodial parent. In situations where the children’s residence is shared, both parents may have this obligation resulting, generally, in a net amount of child support paid from one parent (usually the higher income earner) to the other pursuant to Section 9.

The second component of child support is a payment for additional expenses for the child, defined as “Section 7 expenses” by the legislation. These expenses commonly include:

- child care expenses;

- healthcare premiums attributable to the child;

- “extra ordinary” educational expenses;

- health care costs that exceed insurance reimbursement;

- post-secondary education costs; and

- “extraordinary” extracurricular expenses.

Generally, the parents are to share these expenses in proportion to their respective incomes.

Child support is paid for children under the age of majority (18 years of age in Alberta). Child support may be paid for children over the age of majority if the child is still unable to withdraw from parental charge (for example, if the child is pursuing full time post-secondary education).

Learn more about child support here →

Child Support Calculator

Many factors must be taken into consideration when calculating both spousal and child support such as eligible tax credits, deductions and parenting arrangements to name just a few.

Because every family’s circumstances are unique and these calculations can be very complex, we recommend that you seek advice specific to your situation from both a family lawyer and, in some circumstances, an accounting specialist.

However, to start, you can see the Federal Child Support Guidelines at the Department of Justice website Child Support Table Look-Up here →

Read Important Tips for Using the Table Look-up*

This child support table look-up will help you find the base amount of child support. Read the Step-by-Step Guide and the Table Look-up Disclaimer for more details. The Guide offers instructions and worksheets that will help explain how to calculate child support amounts.

You may wish to ask a lawyer for advice about your situation. The base amount is often not the final child support amount to be paid. For example, if there are special expenses such as child care or if you share custody, the amount will likely be different.

The FCSG tables are designed for the T4 employees and if you are self-employed or have other complexities to your income, there are more steps to income determination. Please seek legal advice.

Under the Federal Child Support Guidelines, the table amount is determined by:

- the number of children;

- the province or territory where the paying parent lives; and

- the paying parent’s before tax annual income.

Table Look-up Disclaimer

The Child Support Table Look-up has general information only. It is not a legal document. The tables were last updated in March 2021. For example, to determine how much child support is owed from December 31, 2011 to February 2017, use the 2017 tables. Note that provincial or territorial guidelines may apply in some cases.

Note: Several companies sell software for calculating child support. Be aware that the Department of Justice was not involved in the development of that software.

Common Law Relationships

If you were in an unmarried cohabitation, your separation may not be governed by the same legal framework as that of married couples; depending upon your date of separation.

The Divorce Act (federal legislation) does not apply to these relationships.

Keep Reading

In Alberta, property division in these common law cases was historically governed by the principles of Constructive Trust and Unjust Enrichment. In plain language, this means that the person claiming an interest in property must show that the other party has been enriched as a result of the contribution (financial or non-financial) of the claimant and that there has been a corresponding loss to the claimant.

These claims generally require a thorough analysis of all the applicable factors and we highly recommend that you consult legal counsel if you believe that this situation applies to you.

Depending upon your date of separation, the Family Property Act may apply to your circumstances whether you are common-law or married or a combination of both.

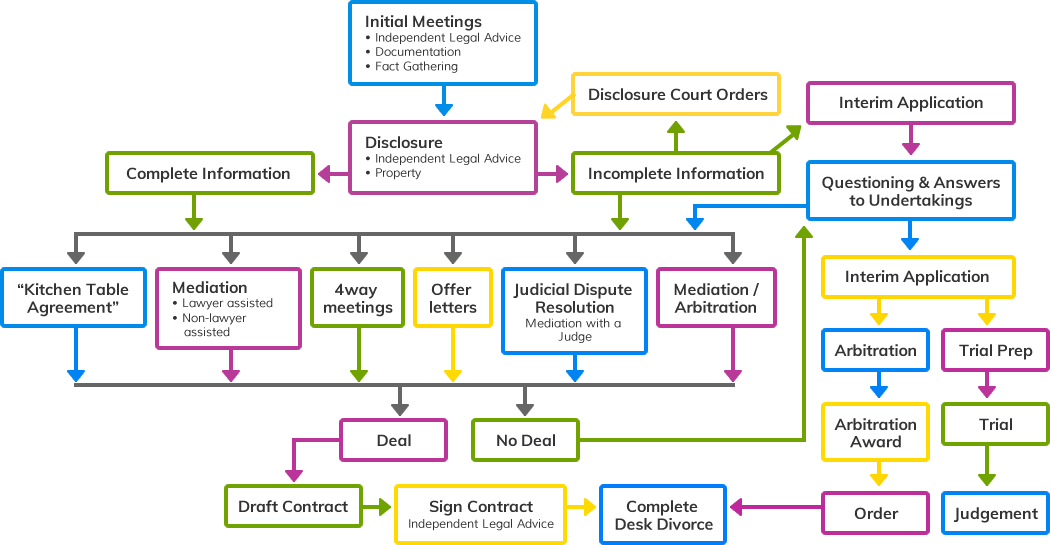

Divorce & Separation: Your Options

How do I get divorced?

The process from separation to divorce can involve many different approaches, from negotiated settlements on your outstanding issues, to mediation, arbitration, or court ordered solutions, or a combination of these approaches. You do not necessarily need to appear before the court to get divorced, but the court does eventually have to grant your divorce judgment.

Keep Reading

How much will my divorce cost?

It is fairly impossible to predict how much your divorce will cost, as the legal costs depend on a number of factors as you go through the process. When you retain legal counsel you will have to pay a retainer fee, which may vary from lawyer to lawyer and sometimes depends on the nature of the immediate steps that need to be taken in a particular case. Generally, the more amicable the parties are in resolving their outstanding issues, the more cost effective the process will be. The lawyers charge based on time spent working on your matter at that lawyer’s hourly rate.

Our experienced family lawyers are happy to help explain the pros and cons of each process option, and what may be the preferred approach in your situation. Learn more about these options below.

Mediation

Mediation is a negotiation facilitated by a neutral third party—a mediator. At WK Family Lawyers LLP we have a number of trained and very experienced mediators. In addition, all of our lawyers regularly attend lawyer-assisted mediation with clients in an effort to achieve a mutually agreeable resolution to issues stemming from the separation.

Mediation is a voluntary process. Any outcomes or agreements reached are non-binding until they are documented into a court order or contract, which has been signed by both parties upon having obtained independent legal advice.

Many clients choose to participate in mediation as their preferred process because it is generally more cost-effective, client controlled and faster than going through the court system. It is also often the preferred mechanism as it helps parties craft their own solutions for their unique family situation instead of relying on a third party to impose the decisions on them.

Get in touch to learn more about mediation →

Arbitration

Arbitration is a common binding alternative dispute resolution process. In arbitration, the parties give an independent neutral third party the authority to make a decision on one or more issues concerning their divorce or separation.

The Arbitrator is often a lawyer trained in arbitration. In Alberta the process is governed by the Arbitration Act, R.S.A. 2000. At WK Family Lawyers LLP we have trained and experienced arbitrators.

Before submitting a matter to arbitration, the parties execute an Arbitration Agreement, which outlines the jurisdiction of the Arbitrator as well as procedural steps to be taken. An Arbitration Hearing can be conducted in various ways depending upon the issues. Some clients decide on a very informal process while others opt for a formal process resembling a trial. Clients typically discuss and decide on the different options most suitable for their case with legal counsel weighing the need for procedural fairness and due process in proportion to the issues being decided.

The decision rendered by an Arbitrator is called an “Arbitration Award”. The Award is a binding decision that can be filed on the Court Record. Parties and counsel sometimes incorporate the document into a court order.

Get in touch to learn more about arbitration →

Settlement meetings

Settlement meetings, also referred to as four-way meetings, are meetings with the parties and their respective legal counsel in attendance. These meetings can be an effective tool for reaching resolution to the issues without incurring the costs associated with the court process. Settlement meetings typically take place in the offices of one of the party’s legal counsel.

Judicial Dispute Resolution

Judicial Dispute Resolution (“JDR”) is essentially a mediation or arbitration facilitated by a Judge/Justice of either the Provincial Court or the Court of King’s Bench, depending on where your court action was commenced.

In most cases, JDRs are a desirable resolution mechanism because they offer parties the opportunity to obtain a without prejudice assessment about the strength of their case from a Judge without having to litigate. JDRs can be binding or non-binding.

Litigation

Litigation is the process of resolving disputes with the assistance of a Judge or Justice who makes a decision on the issues put before them in a court application. In family law, matters put before a Judge or Justice can be of an interim nature or can result in a final order following a trial. Litigation can sometimes be a drawn out process that is taxing on the parties financially and on many other levels. At WK Family Lawyers, we have experience litigating matters at all levels of court in Alberta (Provincial Court, Court of King’s Bench, and the Court of Appeal). Although going to court may not be the preferred process of option for many parties, in certain circumstances it may be necessary in order to achieve a resolution.

Preparing Financial Documents

When it comes to finances, there are no secrets in family law. When going through a separation or divorce, the parties must be prepared to disclose all their financial information to each other. This is a base premise of all process options to ensure a level playing field between the parties negotiating.

Keep Reading

Typically, this starts with the exchange of the following documents:

- Recent tax returns and Notices of Assessment

- Bank statements

- Financial statements for any corporation in which you hold more than a 1% interest

- Investment statements

- RRSP Statements

- Credit card statements

In complex financial situations more detail will be required.

Property Division

In Alberta, the division of property after separation of a married couple is governed by the Family Property Act of Alberta. The Family Property Act is provincial legislation and particular to Alberta. Division or distribution of property in Alberta may differ from that in other Canadian Provinces.

Keep Reading

The distribution of property is primarily dealt with in Sections 7 and 8 of the Act. Generally, property is of one of three types:

- exempt property;

- growth on exempt property or gifts between spouses; and

- any other property (sometimes generically referred to as ‘family property’.

Categorizing the property accurately is critical as that will determine how it is shared between spouses.

Exempt Property

Exempt assets are assets which are generally not shared between the parties and remain the property of the party owning the asset. Examples of exempt assets are:

- property acquired by a spouse by gift from a third party;

- property acquired by a spouse by inheritance;

- property acquired by a spouse before the marriage;

- an award or settlement for damages in tort in favour of a spouse, unless the award of settlement is compensation for a loss to both spouses; or

- the proceeds of an insurance policy that is not insurance in respect of property, unless the proceeds are compensation for a loss to both spouses.

In order for an exemption to be claimed at the end of the marriage, the asset must exist. If the asset is consumed, the exemption is lost. The party claiming an exemption in a certain asset must be able to trace the exemption in order to successfully claim the exemption.

When a party puts an exempt asset into joint names, part of the exempt value is lost. In this situation the Court would assume that there is a gift of one-half of the amount of the exemption to both parties.

Growth on Exempt Property

If an exempt asset increases in value over the course of the marriage, that growth generally is divided between the parties to some extent, although it might not be an equal division. A court would normally analyze what is “just and equitable” under the circumstances. There are a number of legislated factors that a court may consider in terms of how this property should be shared between spouses. Gifts between spouses are likewise shared in this fashion.

Family Property

Any property that does not fall within the categories of ‘exempt property’, ‘growth on exempt property’ or a gift between spouses falls into a third, or ‘catch-all’ category – often referred to as ‘family property’. Family Property is generally acquired during the course of a relationship by either spouse. It does not matter in whose name the property is held or registered. The presumptive approach to family property is that it is distributed or divided equally between the parties.

Parties can contract out of the provisions of the Family Property Act, but only if specific, legislated requirements are met.

Timing

The general approach in Alberta is that assets are valued at the date of Trial, not the time of separation. This is not always the case, however, and warrants a case by case analysis where the values of assets and debts may need to be updated periodically.

Spousal Support

A person may be entitled to spousal support when divorcing or separating (common law arrangements). Many factors are considered in determining spousal support entitlement.

The question of whether someone is entitled to receive spousal support is complex and subject to some discretion. Spousal support ranges will vary depending on the income of each party, how long the relationship lasted and whether or not there are dependent children.

Keep Reading

The Divorce Act sets out the spousal support rules for married couples who divorce. The following factors are considered when deciding if a spouse is entitled to support:

- Financial means and needs of both spouses

- Length of the marriage

- Roles of each spouse during the marriage

- Effect of those roles and the breakdown of the marriage on the current financial position of both spouses

- Care of the children

- Goal of encouraging a spouse who receives support to be self-sufficient in a reasonable period of time

- Any orders, agreement, or arrangement already made about spousal support

Spousal support calculations can be complex. We recommend consulting with your family lawyer to discuss entitlement as well as quantum (amount) and duration of spousal support with you in greater detail.

Useful Resources & Links

Feeling overwhelmed and need to talk to someone?

Distress Centre

Calgary Counselling Centre

Keep Reading

Getting Divorced, Alberta

Family Law, Department of Justice, Canada

Family Law Information, Alberta Courts

Legal Aid Alberta

Alberta Family Mediation Society

Alternate Dispute Resolution Alberta

Association of Collaborative Lawyers Alberta

International Academy of Collaborative Professionals

Court Information

Supreme Court of Canada

Alberta Courts

Legal Sites

Canadian Bar Association

Law Society of Alberta

Legal Education Society of Alberta

Family Law Centre

Statutes and Regulations

National Family Law Program

Property

Alberta Pensions Administration

Canada Pension Plan

Universities Academic Pension Plan

Alberta Teachers’ Retirement Fund

Canadian Public Sector Plan

Also please see the Matrimonial Property Act under: Statutes and Regulations

Parenting

Family Law Centre

Up To Parents

Our Family Wizard

Alberta Children’s Services

Passport Canada *Information about traveling abroad, sample travel authorizations

Spousal and Child Support

Department of Justice Canada Federal Child Support Guidelines

Also please read the Family Law Act and Divorce Act under: Statutes and Regulations

Your Divorce Process Options in Alberta

Confused? We can help guide you through the process.